As consumers are drawn to “pre-loved” clothes and the cost of living problems and concerns over sustainability, vintage clothing sales are expected to account for tenth of the global fashion market in the coming year.

Global sales of pre- owned clothes surged by 18% last year to $197bn ( £156bn ) and are forecast to reach $350bn in 2028, according to a report by GlobalData for resale specialist ThredUp. Due to the fact that global growth is still somewhat behind earlier projections, the milestone is anticipated to be reached a year later than anticipated.

However, the US secondhand market increased seven times as fast as the entire financial sector of fashion, where sales dropped from a time prior to a year earlier.

The co-founder and CEO of ThredUp, James Reinhart, claimed that the resale industry had continued to expand in a challenging business because it was “more adaptable” when household finances were strained by higher energy and food costs.

“When consumer sentiment is softer, price is important”, he said. People are looking to buy used to increase their worth.

He claimed that the demand for secondhand goods was starting to “course generations” and not just for younger buyers looking for trendy sees.

More than half of all customers in the previous year, according to the report, purchased from second-hand by technology Z and teenagers between the ages of 12 and 43. 38% of consumers, or about two in five, said they shop secondhand to get higher end models.

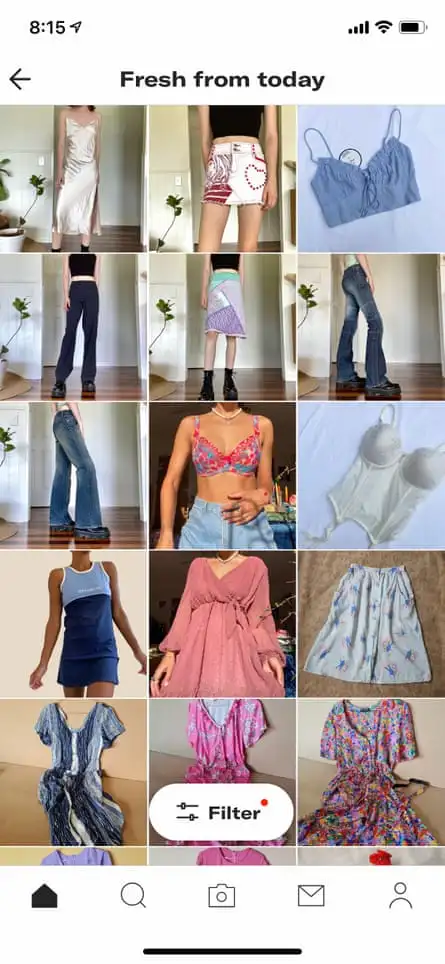

Online resales are anticipated to more than twice in the next five years, reaching $40 billion, which is being driven by the ease of online secondhand shopping at websites like Vinted and Depop, as well as ThredUp, for younger people.

Nevertheless, the tendency towards pre- loved has gained mainstream popularity, with the reality TV show Love Island, today sponsored by craigslist, featuring some contestants acting as influencers to encourage vintage style.

Older buyers are more likely to purchase from physical stores like charity shops and exclusive boutiques. As major retailers from Selfridges to Primark test with opening secondhand sellers, there is now more of “pre-loved” on the high road.

Custom brands are getting creative, working with experts like ThredUp to network resale of their products online or in stores, while children’ swear is the sector’s fastest-growing sector right now. More categories are partnering as their customers want to use their wardrobes to finance new purchases.

Reinhart claimed that businesses are motivated to do more because of pending legislation to limit throwaway rapid fashion around the world.

Given how many clothing ends up in landfill,” It is hard to believe that there will be some exercise in that place in the next three to five years,” he said.

Professional website fashion retailers have found it difficult to make money despite experiencing significant sales growth. Vinted posted a pre- tax loss of €47.1m ( £40m ) in 2022, despite a 51 % rise in sales. Records filed at Businesses House showed Depop’s prior- revenue loss of £59.4m surpassed its £54.3m of income in 2022.

Reinhart predicted that Thredup, which made an actual lost of $2.1 million last year despite sales rising by 14% to $81.25 million, will break perhaps this year on an underlying levels as sales increase more and profit margins increase. “We have a lot of confidence”, he said.